A: We pride ourselves on the convenience of our procedure, which are often completed using and online your phone!

There’s absolutely no faxing, visiting a shop, or signing documents needed. and in case you are fast, it takes lower than 15 minutes!

As soon as your loan is authorized, we will give you your loan by Interac e-mail transfer. Coming back reloan clients may have their cash in less than a quarter-hour.

Alberta

- You fill in the applying form totally on our webpage, by pushing the Apply now! switch.

- Our bodies will be sending you a automatic e-mail with further guidelines and a personalized down load link when it

comes to Inverite Screencap Application.

comes to Inverite Screencap Application. - You download and install the Inverite Screencap Application. You are allowed by this program to securely upload to us screenshots of one’s online banking.

- You log into the online banking utilising the Inverite Screencap Application and talk about 180 days of banking history. You click the Capture switch within the application also it shall send us a display screen capture.

- A second or more times if required, you can send us more screenshots by pressing Capture. (for example, in case your internet banking just shows one of account history at a time) month.

- When you upload some internet banking screenshots, we will immediately start the review procedure. Then email if we need more information we will usually try and contact you by telephone.

- We shall tell you in a message whether your application is accepted or rejected.

- If accepted, you will be emailed a web link to down load your Loan agreement contract!

- You check the page supplied in your e-mail and down load the agreement.

- You browse the agreement in complete, and then consent to it by typing your name within the box supplied to electronically consent to the contact. This comprises a legitimate signature in accordance with Electronic Signature legislation, and is a legitimately binding contract.

- So long as your banking information is verified, you might be entitled to an Interac e-mail transfer, that will allow you to get profit about five full minutes as soon as your loan happens to be activated and approved on our part.

- On the payday that is next will automatically just simply simply take a charge for the total amount of the loan in addition to the borrowing charge, as specified in your Loan contract agreement.

Ontario, Nova Scotia or British Columbia Customers

- You fill in the application type form totally on our internet site, by pushing the Apply now! switch.

- You are expected to validate your identity and banking information with Inverite Verification, a really protected verification business.

- We will inform you in an email whether the application is accepted or denied.

- If accepted, you will be provided with a web link to down load your Loan contract contract!

- You click on the install link in your email and down load the agreement.

- You browse the agreement in complete, and then accept it by typing your title within the box supplied to electronically accept the contact. This comprises a legitimate signature based on Electronic Signature legislation, and it is an agreement that is legally binding.

- Your funds will immediately be sent via Interac e-mail transfer upon signing the agreement.

- On the next payday, we will automatically just simply take a charge for the total amount of the mortgage as well as the borrowing cost, as specified in your Loan contract agreement.

A: Quick response: when our payment programs in your online banking, please check out our website and then click вЂRELOAN NOW. Thoughts is broken logged in, please click вЂApply for a Loan’ and stick to the directions to try to get a reloan with us.

A: To qualify with us, you’ll want to regularly receive income(not self-employed) with a minimum of 1000.00 30 days with no less than 2 payroll deposits with one or more deposit in the earlier 30 days. You really must be paid by direct deposit or cheque. You will need certainly to offer evidence of your revenue by publishing display screen captures of one’s web-banking utilising the Inverite Verification application. We need a total 180 times of banking history. Sometimes, we are going to require also a fax of a void cheque, present pay stubs, a recently available domestic bill or any other evidence of target, or even a bank stamped deposit authorization form that is direct.

After we have actually the given information we want, we assess each loan application separately. You are informed by e-mail whether you qualify, often from the exact same time as the application.

A: If you reside BC, Alberta, or Nova Scotia that is no issue! When you’re completed your application and screen captures, simply email or call us and we also can set that up for you personally. * Loans might not surpass 60 times in total. We are unable to extend this courtesy due to provincial regulations if you live in Ontario. Nevertheless, you might call us after your loan is granted and now we can reschedule your re re payment for you personally.

A: If your position modifications and you also think you could re-qualify, then please re-apply for a financial loan utilising the consumer section of our web site. There’s no necessity for you really to fill in another application that is complete. A client solution rep will likely be thrilled to improve your file if you’re not able to update the information electronically. Please keep in mind that we are able to just process one application per 1 month.

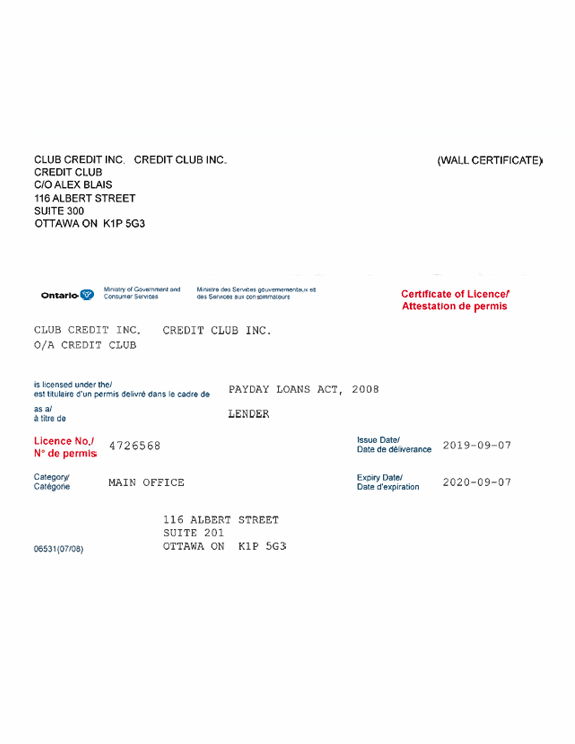

A: Since November 1st, 2009, all lenders that are payday British Columbia must certanly be certified by customer Protection BC.

A: Our main workplace is within Surrey , BC but we likewise have offices all over Canada including in Barrie, ON, and Dartmouth, NS. .

A: This is dependent upon how long you’ve got: you will have to start over if you did not finish filling out the first application form. Your online web browser should keep in mind all of the things you typed into each field however, in the event that you strike the arrow that is down for each industry.

A link is contained by this email to download the Inverite verification application, also guidelines on what to complete.

Reloans

A: to utilize for the reloan, just take a screen that is new of one’s web banking. We are going to have to visit a history that is complete to the beginning of your final loan (or 60 times). We shall see your distribution and acquire back once again to you, often within quarter-hour when we have been open.

It is possible to use the moment your online bank declaration shows our re re payment appearing out of your money. For step-by-step directions, see our reloan guide .

Should this be your next loan for all of us, as well as your employment / paycheque situation hasn’t changed, you will then be qualified to receive that loan of the identical quantity once more.

Beginning with your loan that is third is going to be entitled to borrow a bit more everytime. Call us or an email to go over a rise.